If you’ve ever swiped, inserted, or tapped your credit card to make a purchase, you’ve participated in the marvel of credit card processing. In today’s digital world, where cash transactions are becoming increasingly rare, CC processing plays a vital role in facilitating smooth and secure transactions for businesses and consumers alike.

Introduction to Credit Card Processing

In its simplest form, CC processing refers to the electronic transfer of funds from a customer’s CC to a merchant’s account, enabling the exchange of goods and services. This process has revolutionized the way businesses operate and has become a cornerstone of the global economy.

Definition and Importance

Credit card processing involves a series of steps that ensure the swift and secure transfer of funds between the parties involved. It allows businesses to expand their customer base beyond those who carry cash and provides consumers with a convenient and flexible payment option.

Evolution of Credit Card Processing

The concept of credit dates back centuries, but modern credit card processing as we know it began to take shape in the mid-20th century with the introduction of magnetic stripe cards. Since then, advancements in technology have transformed the landscape, leading to the widespread adoption of chip cards, contactless payments, and online transactions.

Types of Credit Card Processing

Credit card processing methods have evolved to cater to various business models and consumer preferences.

Traditional Terminals

Traditional terminals, often found in brick-and-mortar stores, allow merchants to swipe or insert credit cards to process payments. These terminals are equipped with card readers that communicate with payment networks to authorize transactions.

Mobile Credit Card Processing

Mobile credit card processing enables businesses to accept payments on the go using smartphones or tablets. By connecting a card reader to their mobile device, merchants can securely process transactions anywhere, anytime.

Online Payment Gateways

Online payment gateways facilitate e-commerce transactions by securely transmitting payment information between customers, merchants, and financial institutions. These gateways encrypt sensitive data to protect it from unauthorized access.

Key Players in Credit Card Processing

Several entities collaborate to facilitate credit card processing and ensure seamless transactions.

Payment Processors

Payment processors, also known as merchant service providers, act as intermediaries between merchants and financial institutions. They handle transaction authorization, settlement, and other processing services.

Merchant Account Providers

Merchant account providers offer businesses the necessary infrastructure to accept credit card payments. They set up merchant accounts, provide hardware or software for processing transactions, and manage funds transfer.

Issuing Banks

Issuing banks issue credit cards to consumers and are responsible for authorizing transactions and reimbursing merchants for approved purchases. They play a crucial role in ensuring the security and reliability of the credit card system.

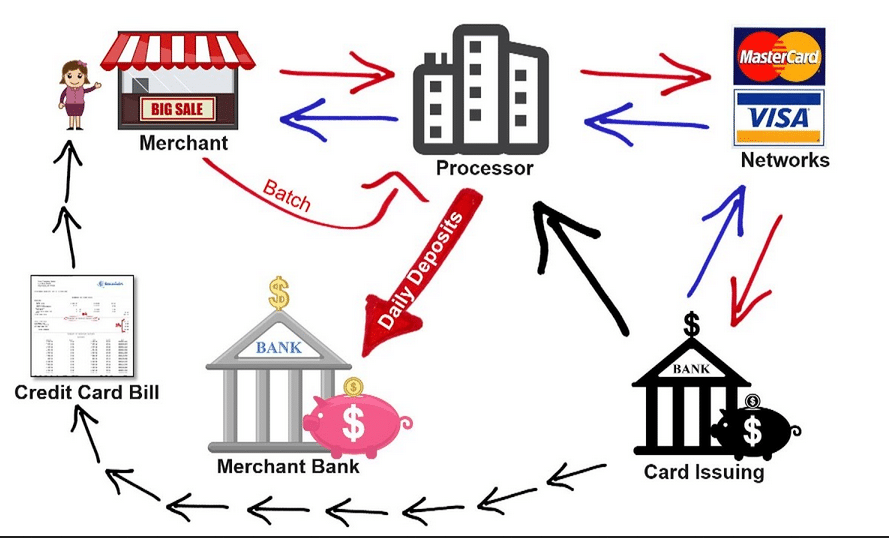

How Credit Card Processing Works

Credit card processing involves several steps that occur in the background to facilitate seamless transactions.

Authorization Process

When a customer presents their credit card for payment, the merchant’s payment terminal sends a request to the issuing bank for authorization. The bank verifies the cardholder’s identity, checks for available funds, and responds with an approval or decline message.

Clearing and Settlement

Once a transaction is authorized, the payment processor forwards the details to the card network (such as Visa or Mastercard) for clearing. During this process, funds are transferred from the cardholder’s account to the merchant’s account, typically within a few days.

Fees Involved

Credit card processing fees vary depending on factors such as transaction volume, card type, and processing method. Common fees include interchange fees, assessment fees, and processing fees, which are charged by the payment processor and card network.

Benefits of Credit Card Processing

Credit card processing offers numerous benefits for both businesses and consumers, driving its widespread adoption in today’s economy.

Convenience for Customers

Credit cards provide consumers with a convenient and secure way to make purchases without carrying large amounts of cash. They offer perks such as rewards programs, purchase protection, and fraud liability protection, further incentivizing their use.

Increased Sales for Businesses

Accepting credit cards can boost sales for businesses by expanding their customer base and encouraging impulse purchases. Studies have shown that consumers tend to spend more when using credit cards compared to cash.

Security Features

Credit card transactions are protected by robust security measures, including encryption, tokenization, and fraud detection algorithms. These features help mitigate the risk of fraud and unauthorized access, providing peace of mind for both merchants and consumers.

Challenges in Credit Card Processing

Despite its many benefits, credit card processing also presents challenges and risks for businesses to navigate.

Risk of Fraud

Credit card fraud remains a persistent threat in the digital age, with fraudsters constantly devising new tactics to exploit vulnerabilities in the system. Businesses must implement stringent security measures to protect against fraudulent transactions and safeguard sensitive customer data.

Chargebacks

Chargebacks occur when a cardholder disputes a transaction and requests a refund from their issuing bank. Excessive chargebacks can result in financial losses and damage to a merchant’s reputation, highlighting the importance of effective dispute resolution mechanisms.

Compliance with Regulations

Credit card processing is subject to various regulations and industry standards aimed at protecting consumers and ensuring fair and transparent practices. Businesses must stay informed about legal requirements such as PCI DSS compliance and anti-money laundering regulations to avoid penalties and sanctions.

Choosing a Credit Card Processor

Selecting the right credit card processor is crucial for businesses to optimize their payment processing operations and minimize costs.

Factors to Consider

When evaluating credit card processors, businesses should consider factors such as pricing structure, contract terms, customer support, and compatibility with existing systems. It’s essential to choose a processor that meets their specific needs and budget.

Comparison of Popular Processors

There are numerous credit card processors in the market, each offering a unique set of features and services. Popular options include Square, PayPal, Stripe, and traditional merchant account providers such as Chase Paymentech and First Data. Conducting a thorough comparison can help businesses make an informed decision.

Tips for Optimizing Credit Card Processing

Businesses can maximize the benefits of credit card processing by implementing best practices and strategies.

Streamlining Checkout Process

Simplify the checkout process to reduce friction and enhance the customer experience. Offer multiple payment options, optimize your website for mobile devices, and minimize the number of steps required to complete a purchase.

Securing Transactions

Invest in robust security measures to protect against fraud and data breaches. Use encryption and tokenization to secure sensitive information, implement multi-factor authentication for online transactions, and regularly update security protocols to address emerging threats.

Negotiating Lower Fees

Negotiate with credit card processors to lower transaction fees and minimize operating costs. Explore opportunities for volume discounts, waive unnecessary fees, and renegotiate contracts periodically to ensure competitive pricing.

Future Trends in Credit Card Processing

The landscape of credit card processing is continuously evolving, driven by advancements in technology and shifting consumer preferences.

Contactless Payments

Contactless payments, enabled by near field communication (NFC) technology, are gaining popularity due to their convenience and speed. Consumers can simply tap their cards or mobile devices to complete transactions, eliminating the need for physical contact or signatures.

Integration with Emerging Technologies

Credit card processing is increasingly integrating with emerging technologies such as artificial intelligence, machine learning, and blockchain. These innovations enable faster transaction processing, enhanced security, and personalized customer experiences.

Enhanced Security Measures

As cyber threats continue to evolve, credit card processors are investing in advanced security measures to protect against fraud and data breaches. Biometric authentication, tokenization, and behavioral analytics are some of the technologies being leveraged to enhance security.

Case Studies: Successful Implementation of Credit Card Processing

Real-world examples illustrate the impact of credit card processing on businesses of all sizes and industries.

Small Business Case Study

A local coffee shop implements mobile credit card processing to accept payments on the go, resulting in increased sales and customer satisfaction.

E-commerce Case Study

An online retailer integrates an online payment gateway into their website, providing customers with a seamless and secure checkout experience, leading to higher conversion rates and repeat purchases.

Retail Case Study

A department store adopts contactless payment terminals to speed up checkout times and accommodate changing consumer preferences, driving foot traffic and revenue growth.

Common Misconceptions About Credit Card Processing

Despite its ubiquity, credit card processing is often misunderstood, leading to common misconceptions among consumers and businesses.

High Fees Misconception

While credit card processing fees exist, they are often offset by the benefits of accepting credit cards, such as increased sales and customer satisfaction. Moreover, businesses can take steps to negotiate lower fees and optimize their processing operations to minimize costs.

Security Concerns Misconception

While security is a valid concern, credit card processors invest heavily in security measures to protect against fraud and data breaches. By implementing best practices and leveraging advanced technologies, businesses can mitigate security risks and build trust with their customers.

Complexity Misconception

Credit card processing may seem complex at first glance, but modern solutions are designed to be user-friendly and intuitive. With the right tools and support, businesses can easily integrate credit card processing into their operations and reap the benefits of accepting electronic payments.

The Impact of Credit Card Processing on Different Industries

Credit card processing has transformed the way businesses operate across various sectors, driving innovation and growth.

Retail

In the retail industry, credit card processing has enabled businesses to offer flexible payment options and streamline checkout processes, leading to improved customer satisfaction and loyalty.

Hospitality

Hotels, restaurants, and other hospitality businesses rely on credit card processing to facilitate seamless transactions and enhance the guest experience. From room reservations to dining payments, electronic payments play a critical role in the hospitality industry.

E-commerce

E-commerce platforms depend on secure and reliable credit card processing to facilitate online transactions. By offering multiple payment options and ensuring a frictionless checkout experience, e-commerce businesses can attract customers and drive sales.

Regulatory Landscape of Credit Card Processing

Credit card processing is subject to various regulations and industry standards designed to protect consumers and maintain the integrity of the payment system.

PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) outlines requirements for securely handling, processing, and storing credit card data. Compliance with PCI DSS is mandatory for businesses that handle credit card transactions to mitigate the risk of data breaches and fraud.

Legal Requirements

In addition to PCI DSS, businesses must comply with federal and state regulations governing CC processing, such as the Electronic Fund Transfer Act (EFTA) and the Fair Credit Billing Act (FCBA). Non-compliance can result in fines, penalties, and reputational damage.

Educational Resources for Understanding Credit Card Processing

Businesses and individuals seeking to deepen their understanding of credit card processing can access a wealth of educational resources.

Online Courses

Platforms such as Coursera, Udemy, and LinkedIn Learning offer online courses on credit card processing, payment technologies, and financial services. These courses cover topics ranging from fundamentals to advanced concepts and are taught by industry experts.

Industry Publications

Industry publications, journals, and blogs provide valuable insights into the latest trends, developments, and best practices in CC processing. Subscribing to publications such as PaymentsSource, PYMNTS.com, and The Nilson Report can help professionals stay informed and up-to-date.

Certification Programs

Professional certification programs, such as the Certified Payments Professional (CPP) designation offered by the Electronic Transactions Association (ETA), provide comprehensive training and credentialing in credit card processing and payment technology. Becoming certified demonstrates expertise and commitment to excellence in the field.

Conclusion

Credit card processing has revolutionized the way businesses transact and consumers shop, offering convenience, security, and flexibility. As technology continues to advance and consumer preferences evolve, CC processing will play an increasingly integral role in the global economy.

In conclusion, credit card processing is not just a transactional process but a cornerstone of modern commerce, driving innovation, growth, and financial inclusion. By understanding the intricacies of credit card processing and implementing best practices, businesses can unlock new opportunities and thrive in the digital age.

FAQs (Frequently Asked Questions)

- What are interchange fees, and how do they impact credit card processing costs? Interchange fees are fees charged by the card networks (such as Visa and Mastercard) to process transactions. They vary depending on factors such as card type, transaction volume, and industry. Interchange fees are typically passed on to merchants by credit card processors and can significantly impact processing costs.

- What is PCI DSS compliance, and why is it important for businesses? PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards designed to protect credit card data and prevent fraud. Compliance with PCI DSS is mandatory for businesses that handle CC transactions to ensure the secure processing, storage, and transmission of sensitive information. Failure to comply with PCI DSS can result in fines, penalties, and reputational damage.

- How can businesses mitigate the risk of chargebacks? Businesses can mitigate the risk of chargebacks by implementing best practices such as verifying customer identities, providing clear product descriptions and terms of sale, maintaining detailed transaction records, and promptly responding to customer inquiries and disputes. Additionally, investing in fraud detection and prevention measures can help identify and prevent fraudulent transactions before they result in chargebacks.

- What are the benefits of contactless payments for businesses and consumers? Contactless payments offer several benefits for businesses and consumers, including increased speed and convenience, reduced transaction times, enhanced security, and improved hygiene, particularly in light of the COVID-19 pandemic. By enabling customers to simply tap their cards or mobile devices to complete transactions, businesses can streamline the checkout process and provide a seamless payment experience.

- How can businesses stay informed about emerging trends and developments in credit card processing? Businesses can stay informed about emerging trends and developments in CC processing by subscribing to industry publications, attending conferences and webinars, participating in professional associations and forums, and networking with peers and industry experts. Additionally, collaborating with reputable credit card processors and technology partners can provide valuable insights and access to innovative solutions.