In the modern era of digital transactions, credit card payment processing plays a pivotal role in facilitating commerce both online and offline. Understanding how credit card payments are processed is essential for businesses and consumers alike to navigate the complexities of financial transactions securely and efficiently.

How Credit Card Payment Processing Works

Understanding the Basics

Credit card payment processing involves a series of steps that occur between the moment a customer swipes, inserts, or taps their card and the final settlement of funds into the merchant’s account.

Authorization Process

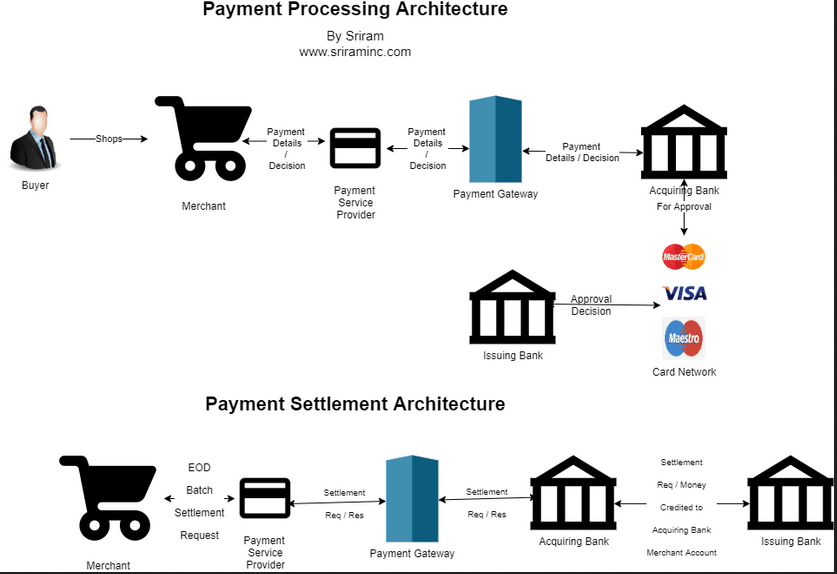

During the authorization process, the merchant sends the transaction details to the payment processor, who then communicates with the issuing bank to verify the availability of funds and approve or decline the transaction.

Settlement Process

Once the transaction is authorized, the settlement process begins, where funds are transferred from the customer’s account to the merchant’s account, typically within a few business days.

Types of Credit Card Payment Processing

There are various methods of credit card payment processing available to businesses, each catering to different needs and preferences.

Point-of-Sale (POS) Systems

POS systems are traditional terminals used in retail stores and restaurants to accept credit card payments in person.

Mobile Payment Processing

Mobile payment processing allows businesses to accept credit card payments using smartphones or tablets, offering flexibility and convenience.

Online Payment Gateways

Online payment gateways enable businesses to accept credit card payments through their websites, providing a seamless checkout experience for online shoppers.

Benefits of Credit Card Payment Processing

Convenience for Customers

Credit card payment processing offers customers the convenience of making purchases without the need for cash, enhancing the overall shopping experience.

Increased Sales Opportunities

By accepting credit card payments, businesses can expand their customer base and capitalize on impulse purchases, leading to increased sales and revenue.

Enhanced Security Measures

Credit card payment processing systems employ advanced security measures, such as encryption and tokenization, to protect sensitive customer data and prevent fraud.

Factors to Consider When Choosing a Payment Processor

When selecting a payment processor for their business, merchants should consider various factors to ensure they find the right solution for their needs.

Fees and Rates

It’s essential to compare the fees and rates charged by different payment processors to find a cost-effective solution that aligns with the business’s budget.

Integration Options

Businesses should choose a payment processor that integrates seamlessly with their existing systems, whether it’s a POS system, e-commerce platform, or accounting software.

Security Features

Security should be a top priority when selecting a payment processor, with features such as encryption, fraud detection, and PCI compliance offering peace of mind.

Challenges and Solutions in Credit Card Payment Processing

Despite its benefits, credit card payment processing comes with its fair share of challenges, which businesses must address to ensure smooth operations.

Fraud Prevention Measures

Implementing robust fraud prevention measures, such as address verification and CVV verification, can help businesses minimize the risk of fraudulent transactions.

Chargeback Management

Chargebacks can occur for various reasons, including disputes, errors, or fraudulent activity. Effective chargeback management processes are essential to mitigate losses and maintain customer trust.

Compliance with Regulations

Businesses must comply with regulations and standards governing credit card payment processing, such as PCI DSS, to protect sensitive customer data and avoid costly penalties.

Trends in Credit Card Payment Processing

The landscape of credit card payment processing is constantly evolving, driven by emerging technologies and changing consumer preferences.

Contactless Payments

Contactless payments, enabled by NFC technology, are becoming increasingly popular due to their convenience and speed, especially in response to the COVID-19 pandemic.

Biometric Authentication

Biometric authentication methods, such as fingerprint and facial recognition, are being integrated into credit card payment processing systems to enhance security and streamline authentication.

Blockchain Technology

Blockchain technology has the potential to revolutionize credit card payment processing by providing a secure and transparent ledger for transactions, reducing the risk of fraud and enhancing trust.

The Future of Credit Card Payment Processing

Looking ahead, the future of credit card payment processing promises continued innovation and transformation, driven by advancements in technology and changing consumer behaviors.

Predictions and Innovations

Industry experts predict that AI and machine learning will play a more significant role in fraud detection and prevention, while blockchain technology will revolutionize cross-border transactions.

Impact of Emerging Technologies

Emerging technologies such as augmented reality and virtual reality may also influence the way credit card payments are processed, offering immersive shopping experiences and personalized payment options.

Conclusion

Credit card payment processing is a vital component of modern commerce, enabling businesses to accept payments securely and conveniently. By understanding the intricacies of credit card payment processing and staying abreast of emerging trends and technologies, businesses can optimize their payment systems to meet the evolving needs of consumers and drive growth.

FAQs

- What is credit card payment processing? Credit card payment processing refers to the steps involved in authorizing and settling credit card transactions between merchants and customers.

- How does credit card payment processing benefit businesses? Credit card payment processing offers businesses increased sales opportunities, enhanced security measures, and improved customer convenience.

- What are the main challenges in credit card payment processing? Challenges in credit card payment processing include fraud prevention, chargeback management, and compliance with regulations.

- What trends are shaping the future of credit card payment processing? Contactless payments, biometric authentication, and blockchain technology are among the trends shaping the future of credit card payment processing.

- How can businesses improve their credit card payment processing systems? Businesses can improve their credit card payment processing systems by choosing the right payment processor, implementing robust security measures, and staying updated on emerging technologies and trends.